Forward contracts are a form of derivatives, along with futures, swaps, and options, which are contractual agreements between separate parties that derive value from the underlying assets. Forwards are commonly used by corporate investors or financial institutions, and it is less common for retail investors to trade them.

However, individual investors should know how they are used and relate to other forms of derivatives utilized for investing. This guide will explain what forward contracts are, how and where they are used, and highlight their risks and advantages.

Best Crypto Exchange for Intermediate Traders and Investors

30+ million UserseToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

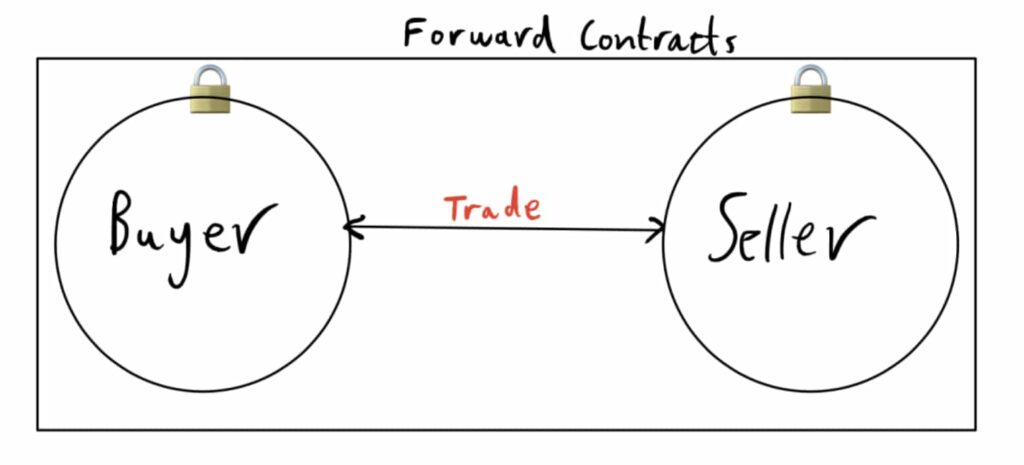

A forward contract is a contractual agreement between two parties – a buyer and a seller – to lock in the current price of an asset at a set date in the future. A forward contract is the basis of derivative contracts, which are agreements that get their value from the underlying assets.

It is important to note that a forward contract isn’t an asset class itself but derives its value from the underlying assets, which can be typically commodities like oil, gold, wheat, or livestock, or currencies like Euros or US Dollars.

Institutional investors more commonly use these contracts to hedge risk used as a protection against rising costs of raw materials. Corporations or other financial institutions use forwards to lock in commodity prices, currency exchange rates, or trade currency interest rates.

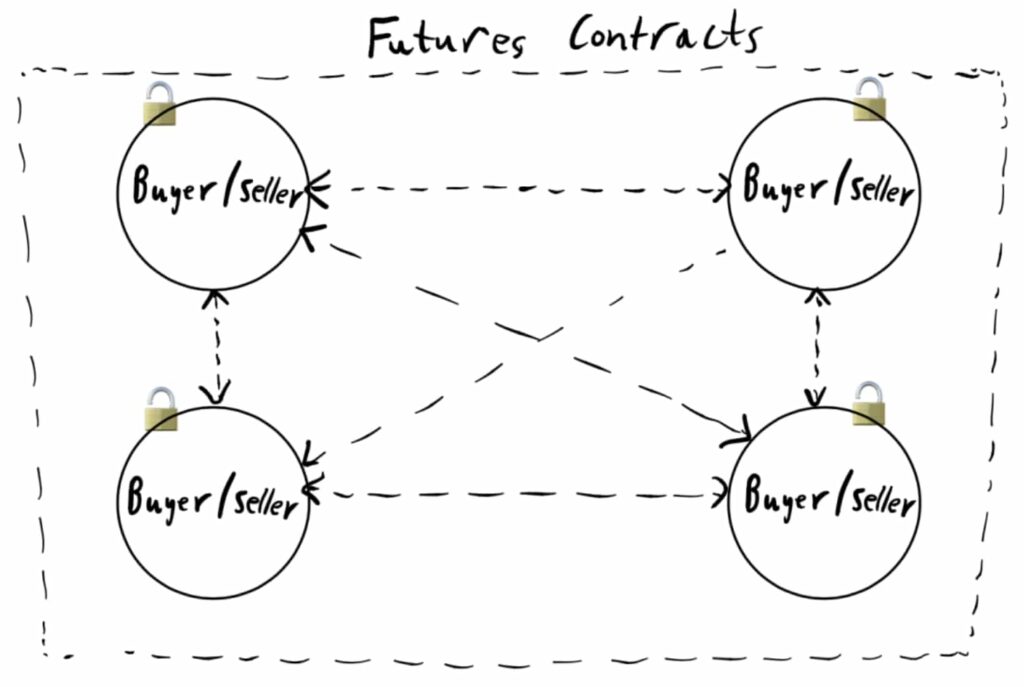

Forward contracts are often contrasted with futures contracts, as both are used to hedge risk from the price volatility of the underlying assets; however, whereas futures are traded on exchanges and are therefore regulated, forwards are traded over-the-counter (OTC).

It means that forwards come with a counterparty default risk, which means there is a chance that one side isn’t able to stick to the agreement and pay the outstanding balance.

However, the fact that forwards are traded OTC makes them more flexible and customizable compared to their counterparts – futures contracts.

Beginners’ corner:

There are four key differences between forward vs future contracts: forwards are non-transferable, customizable, and illiquid, as well as exposed to counterparty default risk. Details like quantity, expiration date, and price can be adjusted as agreed upon in the contract between the two parties privately.

Futures contracts, on the other hand, trade on exchanges, which means they are regulated and less risky as there is no counterparty risk involved, and are transferable and standardized. It means that key terms and conditions like delivery date, quantity, or the price in the standardized contract can not be changed.

The more flexible and customizable nature of forwards makes them more preferred and attractive to hedgers or institutional investors, adjusted to each party’s individual needs.

Futures contracts are more liquid as well as transferrable, which is why they are preferred and more suitable for trading by speculative or individual investors.

Just like futures, forwards are legally binding and obligate investors to buy or sell the underlying asset at a fixed price determined in the contract, however, they are settled only when the contract expires, as opposed to at the end of each day like for futures. Similar to futures, forwards can be settled on either physical delivery or cash settlement.

Best Crypto Exchange for Intermediate Traders and Investors

30+ million UserseToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Two sides involved in the agreement can use this contract to manage price volatility by locking in the prices of the underlying assets. In a forward contract, a buyer takes a long position, whereas the seller takes a short position.

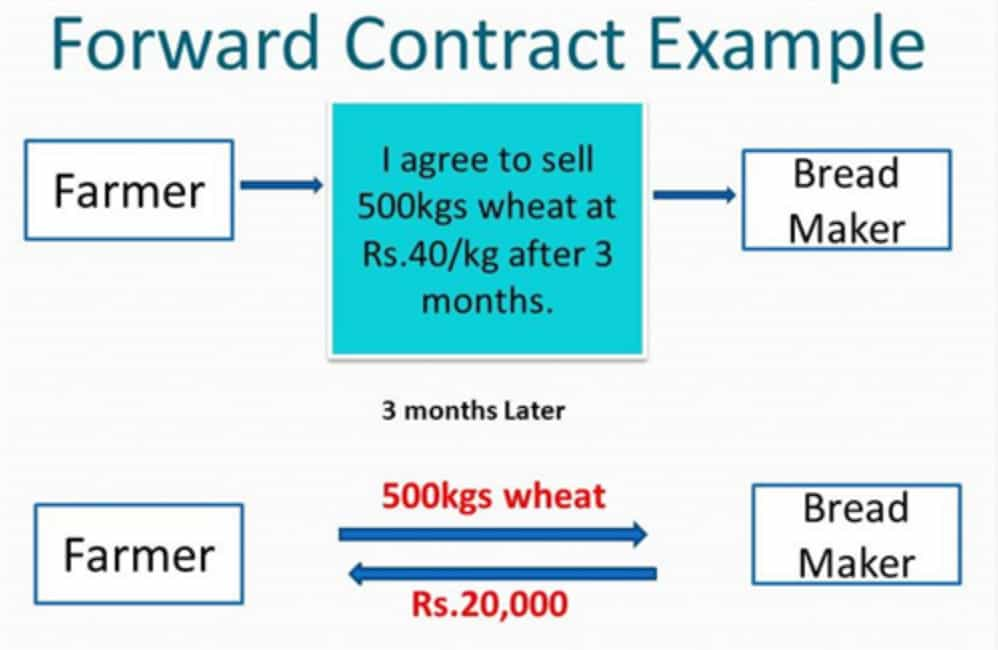

For example, a corporation needing wheat to produce cereal is the buyer, and a farmer growing wheat is the seller. The investor buying the asset, in this case, the cereal company, takes the long forward position, a position of ownership of the underlying asset, whereas the farmer, the seller, takes the short forward position.

Before a contract agreement, the spot price, also called the spot rate, has to be determined – the current price of a commodity or another asset like security or currency available at the market for immediate delivery. For example, if you wish to immediately purchase a pound of sugar, you would have to pay the current market price.

Opposite to the spot rate is a forward rate, also called a settlement price or delivery price, which is the agreed-upon price of the underlying asset determined between two parties in the forward contract, to be paid when the contract expires and delivery or cash settlement is made.

No money or underlying assets exchange hands when the contract is written, and the settlement only occurs at the end once the contract expires. Moreover, forward contracts must be adhered to as they are legally binding, and they oblige both parties to carry out the trade.

A long position means they think the price will increase in the future, and a short position means they believe the price of an asset will decrease and want to lock in the current higher price. In the end, one party will gain, and the other will lose in relation to the spot price, the actual current price at the market, at the time of the contract expiry.

Forward contracts are typically used to hedge prices of commodities or currency interest rates by large corporations or financial institutions – hedgers, as they are non-standardized and more flexible than futures; however, they can also be used by speculators.

A forward can protect the buyer of the contract against price hikes and the seller against price drops, which makes them well-suited for risk management and more appropriate for hedging by institutional investors rather than individual investors.

When a forward contract is signed, one party agrees to sell (the supplier), and the other party consents to buy (the company) the underlying asset at a set price at a set future date.

Hedging means using financial instruments such as derivative contracts to reduce future risk from increasing prices. An airline that needs large quantities of oil might want to lock in current prices as they think the cost will increase in the future.

For example, that airline, the buyer, would enter a forward contract with the oil supplier, the seller, to agree to buy X quantity of oil at X price at X delivery date. It’s a way to balance operational costs for the company as they will know exactly how much they’ll spend in the near future – as the current price of the oil is known, the future price isn’t.

Another common use of forwards is as a hedge against currency exchange rates when expanding internationally or making large purchases.

Lastly, even though less common, forward contracts can be used for speculation. For example, speculating that the future price of the underlying asset will be higher than the current price today and entering a long forward position. This way, if the future spot price of the asset has increased and is higher than the delivery price – the agreed-upon price stated in the contract, individual investors who took a long forward position will profit.

Since forwards are traded over-the-counter, settlement can only happen in one of two ways once the contract expires: physical delivery or cash settlement.

If the contract is settled on a delivery basis, the seller has to deliver the underlying assets to the buyer of the contract. For example, the supplier of wheat has to deliver it in the quantity, price, and delivery date specified in the contract to the buyer. If the contract is settled on a cash basis, then the buyer pays the seller the agreed-upon price or any outstanding differences.

Under physical delivery, the buyer, who is in the long position, pays the seller, who is in the short position, when the contract expires and delivers the underlying physical assets at the predetermined agreed-upon quantities and prices – the forward contract transaction is finalized.

While the concept of physical asset delivery is easy to grasp, the implementation of short position holders, assuming the price will drop, is more complex and is completed via a cash settlement process.

A cash settlement is a method commonly used both in forwards, as well as futures and options. It is where the seller of the underlying asset doesn’t physically deliver the commodities or other assets but settles with a cash transfer for the cost difference.

As forwards are non-standardized and traded over-the-counter, they can be adjusted as preferred by both parties, the buyer and the seller – the key details that should always be written in a forward contract are:

Although the term forwards is used as a reference to a general asset class in finance, the value of the contract itself derives from the underlying asset class, which is commonly either a commodity forward or a currency exchange forward used by corporate investors.

Similarly to futures contracts, the underlying assets of forwards can be different types of commodities like energy: oil, gasoline; metal: gold, silver, copper; agricultural products: wheat, sugar, coffee, cotton, grains; or livestock: cattle, lean hogs, etc.

When a farmer thinks prices will drop, he can sell wheat in large quantities and lock in current prices, whereas if a company needs wheat in their production process to make other products, they can enter into a forward contract.

The seller, a corn supplier, agrees to sell 1 million bushels of corn at the price of $4 per bushel to a cereal company; they settle in the forward contract that it will be delivered on the 1st of October.

At the expiry of the contract on the 1st of October, that same corn is actually selling for $3 per bushel, meaning that the cereal company who assumed prices would increase, is not benefiting from the forward agreement anymore and is due to receive the asset from the supplier which is now worth $3 per bushel but has agreed to pay $4 per bushel.

In a case of a cash settlement, the buyer would make a cash payment of $1 per bushel to the farmer, paying for the difference that is owed to the farmer, and who gets the same value overall as stated in the forward contract.

The farmer can still sell its product in the open market for $3 per bushel, but receive the net difference of $1 from the company, and the buyer – the company, can now buy the corn on an open market for $3 per bushel.

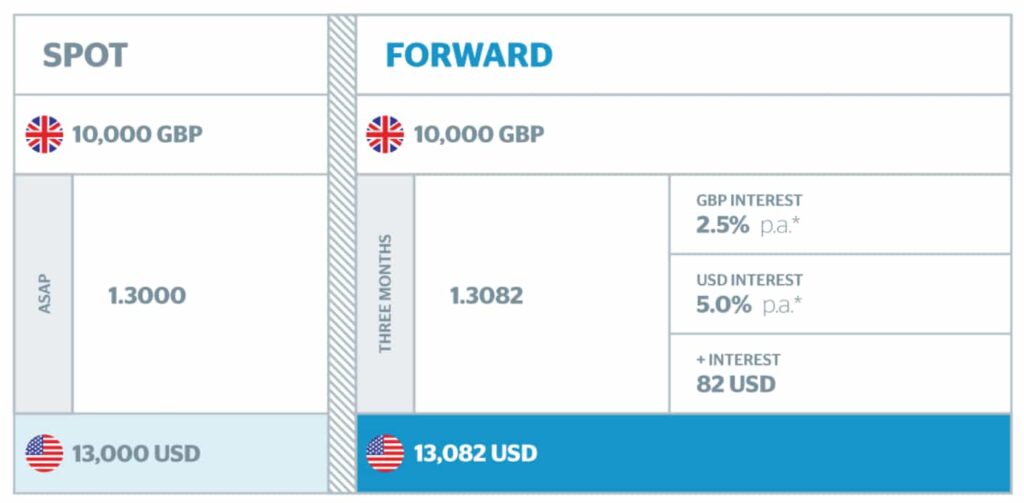

A currency forward is a contract binding for both sides, trading in the foreign exchange (FOREX) market, which is a global over-the-counter market for trading different currencies.

Foreign exchange specifies the current exchange rates for currencies, including everything about trading and exchanging them.

Currency forward is an essential solution for institutional investors used as a hedging tool and is customizable. One of the benefits is that it doesn’t require an upfront margin payment and can be tailored to any amount necessary, unlike exchange-traded currency futures.

A currency trader works for a large company that operates in several different markets and currencies. That company is based in the US; however, it also sells in Canada; hence, they sell products and generate revenue in different currencies. A portion of their sales are in Canadian dollars; ultimately, they need to be exchanged back to US dollars.

The trader would need to know the spot rate – the current exchange rate and the forward rate, between the US dollar and Euro in the open market, including the difference between the interest rates in the two countries. For example, the current rate for US dollars $1 equals Canadian dollars $1.05, and the one-year interest rate for Canadian dollars is 4%. In contrast, the one-year interest rate for US dollars is 1%.

Or for example, an exporter company based in Canada is worried the Canadian dollar will strengthen from the current rate of C$1.05 a year on, which would mean they receive less in Canadian dollars per US dollar. The exporter can enter into a forward contract to agree to sell $1 one year from now at a forward price of US$1 to C$1.06.

If in a year, the exchange rate is US$1 to C$1.03, it means that the Canadian dollar has appreciated in value as expected by the exporter. By locking in the previous exchange rate – the forward rate, the exporter has benefited and can sell US$1 for C$1.06 instead.

But if the new exchange rate is at C$1.07 at the time of the contract expiry, meaning that the Canadian dollar has weakened, the export company will incur a loss.

Other examples of forward contracts include selling individual stock securities, indexes, fixed-income forward contracts on securities like treasury bills, and interest rate forward like the London Interbank Offered Rate (LIBOR), more known as forward-rate agreements.

Forwards can be categorized into different types of contracts based on two things: underlying asset and structure of the forward contract, for investors to be aware.

A non-deliverable forward contract doesn’t include any physical exchange of assets; it means that instead, two parties only exchange cash for settling the contract. The outstanding amount to be paid depends on the price specified in the contract – the forward price and the asset’s current market value.

A long-dated contract structure doesn’t depend on whether it is flexible or closed, and it is to be executed at a longer time in the future as opposed to the short-term forward. Most forwards are signed to expire within three to six months to a year, whereas long-dated forwards can last for a year or even longer.

Investors can execute a contract before or at the expiration date in case they agree on a flexible forward. Two parties can both agree to settle the contract before the date set in it, and settlement can also happen either in one transaction or multiple payments.

A closed forward contract is where the rate is fixed, and it is a standard; it is where both parties agree to finalize an agreement transaction on the set specific date in the future.

Forwards can offer several benefits to both parties, such as privacy, and the fact that they can be customized to each party’s specific requirements and needs. As these contracts are private, it is hard to assess the size of the forward market and the true extent of its risks.

Due to the lack of that transparency, there are several risks involved in forwards, some of which include being subject to counterparty default risk and the setting up of contracts with an improper structure which can cause issues later down the line; it is advantageous to keep common investing mistakes in mind.